Capturing the Opportunity: A Look at Carbon Capture and Utilization

Power Magazine

William Lese

February 1, 2023

An important part of the global effort to curb emissions of carbon dioxide (CO2) is development of technologies to capture CO2, to design ways to store it, and to find beneficial ways to use it.

Addressing climate change is an ongoing challenge for humanity, one that is critical not only for our overall quality of life but for the survival of our planet. The good news is that significant progress is being made in confronting this issue. The big question is, can we accelerate this progress to truly meet the challenge head-on?

A key driver of progress has been the 2015 Paris Agreement, itself an evolution of the 1997 Kyoto Protocol, which set a goal to limit global warming to below 1.5C compared to pre-industrial levels. The Paris Agreement is structured to incentivize creation of competitive economic solutions to limit global warming, aiming for zero-carbon solutions to replace 70% of global emissions by 2030.

Reducing overall carbon emissions is clearly a challenge of enormous magnitude that will require global commitment, ongoing innovation, and significant investment. The International Energy Agency (IEA) has estimated that 100 billion tons of CO2 must be stored by 2060 to avoid a harmful global temperature rise of 2C. The science of carbon capture and storage (CCS), along with related carbon capture and utilization (CCU), are two potential solutions in what must become an expansive toolbox.

Carbon Capture 101

Carbon capture and storage (or sequestration) in its primary method is the process of capturing carbon dioxide emitted from burning of fossil fuels during power generation and industrial processes, and storing it to prevent release into the atmosphere. More recently, direct air capture (DAC) systems have also come into use.

One of the primary uses of CO2 is for enhanced oil recovery (EOR), a method of extraction used for decades that injects CO2 and water to drive oil up the well, improving recovery output. This process sequesters the CO2 underground, so the resulting oil has a lower carbon footprint than conventional oil. Selling CO2 for EOR and other uses can provide revenue to CCS facilities, incentivizing broader implementation of these systems.

Current CCS technologies have significant potential to reduce CO2 emissions in energy systems. Facilities with on-site CCS can capture almost all the CO2 they produce; some as much as 90% or even 100%. Over the past 10 years, deployment of CCS technology has steadily grown, with about 40 million tons of CO2 captured and stored, and/or used, in 2022 (more on utilization below). While this is a significant achievement, it is still not enough to have a meaningful impact on climate change. Meeting the objectives of the Paris Agreement will likely require global carbon capture capacity to reach multiple gigatons per year by 2050.

In terms of global deployment, there are 196 CCS projects in the pipeline, according to the most recent Global CCS Institute report. This translates to 30 facilities in operation, 11 under construction, 153 in development, and two that were suspended. Most of the growth in 2022 occurred in the U.S., with 34 new projects; Canada was second with 19.

Combined with those already under construction or in operation, these facilities could capture about 149 million metric tons of CO2 per year. But that is still a small fraction of overall annual carbon emissions. For comparison, the U.S. Energy Information Administration estimates that in 2019, the U.S. emitted more than five billion metric tons of energy-related CO2 alone.

CCS Infrastructure and Risk

There are some notable disadvantages associated with CCS. Capturing massive amounts of carbon, transporting it over many miles, and storing it in caves or salt aquifers is not dissimilar to putting trash in a landfill. This makes CCS effectively a waste disposal business—an expensive process that requires specific geological infrastructure and ongoing measuring, monitoring, and management.

There is also an attendant risk of leaks that can release stored CO2 back into the atmosphere, as happened in Satartia, Mississippi, in February 2020, when a 24-inch pipeline ruptured. That incident, caused by heavy rainfall that compromised the supporting terrain, released nearly 22,000 barrels of liquid CO2 into the surrounding community.

Currently, there are about 5,000 miles of carbon dioxide pipelines in the U.S., mostly for repurposing captured CO2 for use in EOR. If carbon capture and storage projects were to increase significantly, the country’s CO2 pipeline network would also need to expand.

As states move forward with enacting rules and regulations for underground CO2 storage, a key question is who will assume long-term responsibility for projects that could require monitoring for decades.

Follow the Money

With the heightened activity around pursuing global emission reduction goals, there has been an increase in incentives and investments to support low-carbon solutions. Some significant incentives for carbon capture, utilization, and storage (CCUS) deployment were enacted in the U.S. Inflation Reduction Act. These include extending the timeline for construction starts; lowering thresholds for captured qualified CO2; and increased credits for captured carbon (up to $180 per ton). The 2021 Infrastructure Bill also earmarked more than $12 billion for carbon capture projects and infrastructure.

Venture capitalists and companies spanning the fossil fuel, clean energy, and related technology industries are accelerating efforts to capitalize on opportunities in carbon removal services. New research has led to reports that the global CCUS market is estimated to be $2.84 billion in 2022, and could reach $9.43 billion by 2027.

Investments in post-combustion carbon capture companies and startups totaled a record-breaking $882.2 million across 11 deals in the second quarter of 2022. The most significant deals were DAC company Climeworks’ $634.4 million funding round, and point source capture company Carbon Clean’s $150 million investment raise. As an indicator of the sector’s promise, a Bloomberg News survey determined that carbon capture was the fourth-most attractive area for potential environmental, social, and governance (ESG) investment—after battery storage, solar and wind, and hydrogen.

The CCU Opportunity

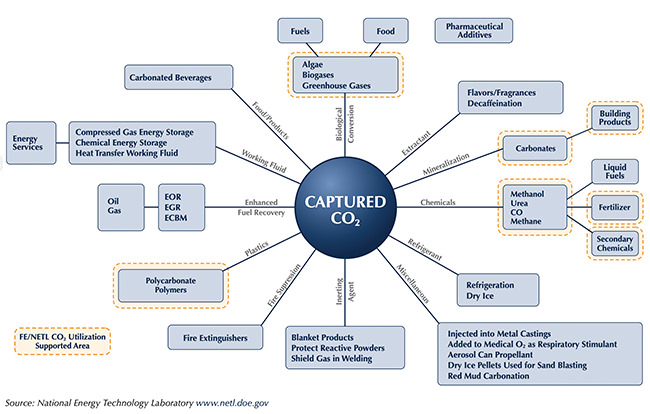

Captured CO2 can also be used to produce manufactured goods or applied to industrial and other processes (Figure 1), rather than be limited to EOR or underground storage. CCU is a more climate-beneficial process, since the carbon is used or converted for a purpose. It also eliminates the need to construct and maintain specialized storage infrastructure.

1. There are many industries that can benefit from captured carbon dioxide, representing a multitude of potential use cases. Source: National Energy Technology Laboratory (NETL) / U.S. Department of Energy

Different CO2 use cases result in different levels of emissions reductions, depending on the specific application and what fuels or other materials the CO2 may be displacing. The ultimate impact on climate change depends on whether these uses lead to permanent sequestration of the CO2.

A number of startups have developed technologies and methods for capturing and using carbon in more practical ways. Given the imperative to reduce new carbon emissions and atmospheric CO2 levels, these companies are piloting a number of possible pathways to get there—and raising capital to accelerate their efforts.

One example of industrial-use CCU is CarbonFree, which is commercializing its second-generation SkyCycle technology platform to capture CO2 from industrial flue gases and mineralize it into carbon-negative calcium carbonate. That technology represents a $40 billion global market with applications in the paper, polymer, and health industries. In addition, the process produces significant amounts of hydrochloric acid that can also be sold or reused.

2. The CarbonFree SkyMine plant is located in San Antonio, Texas. The plant came online in 2015 as the world’s first and largest industrial-scale carbon mineralization facility. The SkyMine plant annually captures up to 50,000 tons of CO2 from cement flue gas, transforming it into carbon-negative baking soda (sodium bicarbonate) that is available for purchase by the general public.

Courtesy: Braemar Energy Ventures

CarbonFree’s SkyMine plant in San Antonio, Texas (Figure 2), came online in 2015 as the world’s first and largest industrial-scale carbon mineralization facility. The SkyMine plant annually captures up to 50,000 tons of CO2 from cement flue gas, transforming it into carbon-negative baking soda (sodium bicarbonate) that is available for purchase by the general public.

Another example is the Air Company, which offers novel uses for captured CO2 by turning it into low-carbon consumer products such as vodka and perfume. The technology has the potential to replace significant amounts of fossil-based carbon in chemicals and fuels. California-based Twelve is another early mover in this area of CCU innovation.

Scaling Up

The scale of the CO2 reduction challenge is truly worldwide, so the solutions deployed will need to be equally global. Carbon dioxide emissions from fossil fuels and cement increased by 1% in 2022, according to the Global Carbon Project, reaching a record high of 36.6 billion tons of CO2. CCS plants and related infrastructure will continue to be built, predominantly by oil companies pursuing government incentives and carbon offsets. But more is needed.

While it’s still in the early days, a number of new CCU technologies show promise on a small scale and have the potential for global deployment. As with any new industry, reaching commercial scale presents challenges. But similar to other technologies addressing the energy transition, with the proper resources, determination, and incentives, the future looks bright for CCU.

—William Lese is managing partner for Braemar Energy Ventures, a company that since 2003 has been investing in transformative energy technology companies.